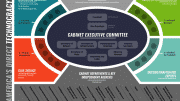

The Medical Countermeasures Consortium is a military partnership between the United States, Australia, England and Canada that seeks to "develop medical countermeasures to assist with… chemical and biological threats affecting civilian and military populations and on emerging infectious diseases and pandemics."

Pandemic

You are about to see One Health in action. According to the CDC, "interconnection between people, animals, plants, and their shared environment," it is fair game for them to make the connection between between "sick cows", the milk they produce, and the next human pandemic. Is spurious at best, and fraudulent at worst.

Pandemic

Technocracy seeks to take over the entire planet. The late Rosa Koire saw Sustainable Development, aka Technocracy, as “the blueprint, the comprehensive plan of action for the 21st century to inventory and control all land, all water, all plants, all minerals, all animals, all construction, all means of production, all energy, all law enforcement, all health care, all food, all education, all information, and all human beings in the world.”

Health Systems

Trilateral Commission Policy On Immigration Destroyed Britain (And It Will Destory America, Too)

‘One Health’ Is A Cult Based On Gaia Worship, Wicca, Neo-Paganism

Genetic Engineering, Health Systems